Walmart, Inc. (NYSE: WMT) has become the king-maker retail stock in 2024. It’s already the world’s largest retailer and within two years it is expected to post more than $700 billion in annual sales. Wall Street just seems as though it cannot get enough of Walmart beating earnings expectations, growing same-store sales, expanding its market share and even delivering on the e-commerce frontier.

The world’s largest retail briefly hit a new all-time high of $88.29 and managed to close up 3% at $86.60 on Tuesday after its strong earnings report. Its stock rose another 0.67% to close at $87.18 on the day after earnings as well.

Tactical Bulls cannot help but notice how almost every analyst rating the company has raised their firms’ price targets all over again. It has turned into an analyst upgrade brigade when you consider the price changes now that Walmart is up 66% year-to-date.

Be advised that the opinions and price targets represented in this report are from each brokerage firm’s coverage universe. Tactical Bulls does not have any formal rating or formal price target on Walmart. Tactical Bulls is not making any recommendation to buy or sell Walmart or any named competitors and readers should verify any figures and claims independently.

And to show that Walmart isn’t just a story of luck or just an economic beneficiary, all investors have to do is look at the current day’s performance of Target Corporation. Its stock fell a sharp 21.4% to $121.72 and the 60+ million shares that traded hands was abouy 15-times its normal trading volume.

The performance of dollar stores has also continued to be depressed in 2024. Dollar General Corporation (NYSE: DG) is down a sharp 46% YTD. Shares of Dollar Tree Inc. (NASDAQ: DLTR) are down 55% YTD.

SOME DETAILED VIEWS

BofA Securities has had a Buy rating on Walmart for several years now. The firm’s Robert Ohmes just reiterated his Buy rating and raised the price objective to $105 from $95 on the heels of a solid earnings report. Some of the drivers are a rise in market share, strong retail values when consumers need value, its digital strength, remodels, express delivery higher margin expansion, its marketplace and even reaching up for higher-end consumers. The investment rationale summarizes it clearly:

We believe Walmart’s omni-channel transformation in the US will continue to gain momentum and support more sustainable and predictable positive same-store sales and traffic at US Supercenters and US ecommerce and GMV growth that should support P/E multiple expansion.

CRFA (S&P) reiterated its Buy rating and raised its price target to $96 from $92 in this independent research call. The hike reflects growth of higher-margin services revenue, fulfillment services, data monetization, and even its membership revenue. Margin expansion is also expected to continue along with improving ecommerce profits after the retail giant raised its full-year sales and earnings guidance.

Morgan Stanley reiterated its Overweight rating and raised its target to $100 from $89 in the call. The firm’s Simeon Gutman said that their Retail Funnel shows that the big are getting bigger at an accelerating rate and that the nation’s top retail players are taking 50% of incremental retail sales and over (among Amazon, Walmart and Costco) 75% of incremental eCommerce sales. Gutman highlighted that Walmart’s share of incremental sales has steadily increased for 3 consecutive quarters and is now 12.2% in Q3-2024 versus just 8.8% in Q4-2023.

THE PRICE TARGET HIKE BRIGADE SAYS…

Other key analyst summaries show that even some of the less aggressive ratings all came with price target hikes. Tactical Bulls featured Walmart a week earlier as analysts not being able to get enough — but that it set the bar high for the stock to continue. It still beat the higher bar. The new analyst price targets and ratings tracked after earnings was as follows:

- Baird reiterated Outperform, target to $100 from $90

- Bernstein reiterated Outperform, target to $102 from $98

- BMO reiterated Outperform, target to $100 from $80

- Evercore ISI reiterated Outperform, target to $94 from $89

- Guggenheim reiterated Buy, target to $100 from $90

- Jefferies reiterated Buy, target to $105 from $100

- KeyBanc reiterated Overweight, target to $96 from $88

- Piper Sandler reiterated Overweight, target to $93 from $83

- RBC reiterated Outperform, target to $96 from $92

- Roth MKM reiterated Buy, target to $97 from $81

- Stifel reiterated Hold, target to $89 from $85

- TD Cowen reiterated Buy, target to $100 from $90

- Telsey Advisory reiterated Outperform, target to $100 from $92

- Truist reiterated Buy, target to $98 from $89

- UBS reiterated Buy, target to $100 from $92

- Wells Fargo reiterated Overweight, target to $96 from $90

DISCLAIMER

Tactical Bulls always reminds investors and its readers that no single analyst report should ever be the sole basis to buy or sell a stock. The same is true even when multiple analysts are all out upgrading their ratings and/or price targets in unison. The decision to buy or sell, or hold or short sell, is up to each investor and the decision should be made with a financial advisor. And there are of course no assurances that any of the price predictions and the scenarios that back the calls up will actually come to fruition.

LONG-TERM CHART

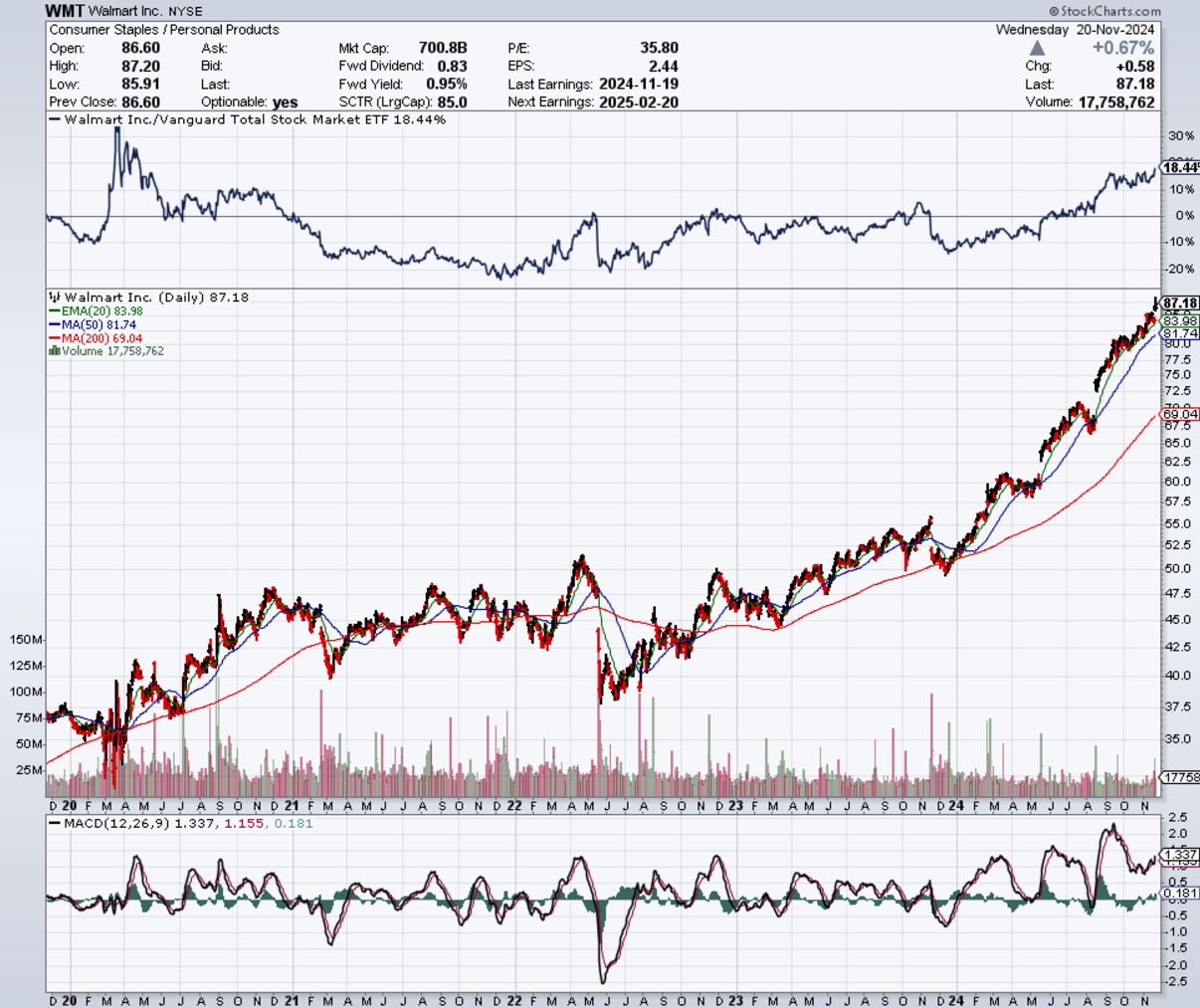

It’s one thing for Walmart to be up over 60% this year alone. Walmart had been a rangebound stock from 2020/21 into 2023 before its shares took off. The stock has nearly doubled from the lower-end of its trading range. A 5-year chart has been shown courtesy of StockCharts.com for your review.

courtesy of StockCharts.com

Categories: Investing