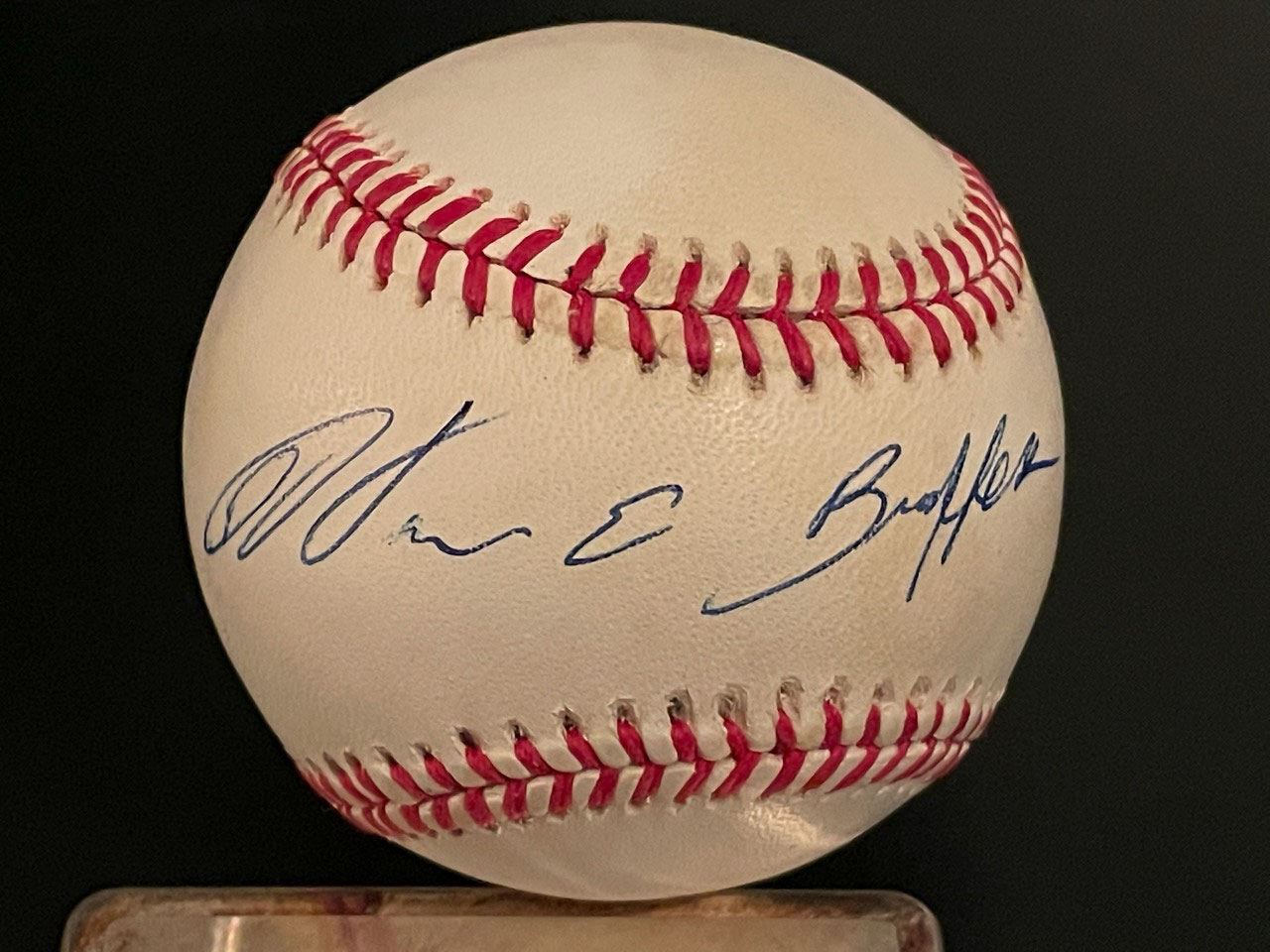

My personal collection Warren Buffett signed baseball

If you hear the name Warren Buffett and “he bought shares of…” in the same sentence, it means a whole bunch of investors just started paying attention. The new 13F filing from Berkshire Hathaway, Inc. (NYSE: BRK-A) disclosed that Buffett and his portfolio managers have added new stakes of Domino’s Pizza, Inc. (NYSE: DPZ) and Pool Corporation (NASDAQ: POOL) into the Berkshire Hathaway portfolio of public stocks.

There is no way to know what date the transactions were made from the basic filings, but these stakes were invested into sometime between July 1 and September 30, 2024.

PIZZA MAN!

Domino’s Pizza, Inc. (NYSE: DPZ) has had its share of problems in 2024. With consumers opting for experiences rather than having everything brought to them, Domino’s stock was up barely 5% so far in 2024 and down about 20% from its 52-week high. Now Domino’s has a new fan and it is running the shares higher — enter Warren Buffett and Berkshire Hathaway, Inc. (NYSE: BRK-B).

The new 13F filing from Berkshire Hathaway disclosed a stake of 1,227,256 shares of Domino’s that is worth about $535 million based on the late-day price of $435.97. To prove that Buffett and his portfolio managers do matter as a stakeholder, the value of the stake after a 7.8% gain in the after-hours was suddenly worth $575 million. This would represent close to a 3.5% stake and would make Berkshire Hathaway the 7th largest stakeholder in Domino’s if none of the June 30 stakes changed by the other top-10 holders.

GONE SWIMMING!

Pool Corporation (NASDAQ: POOL) is another one of those stocks that has been basing out after the “stay at home” trade during the pandemic led to floods of new pools being built. That then led to the need for massive amounts of pool supplies. After surging from $175 in 2020 to over $550 by late-2022, Pool was done as a massive beneficiary of the work from home and stay at home gains. People have moved back to outside experiences away from home rather than nest-building. But apparently trading at $300 to $400 for most of the last two years was good enough for a point of entry.

The latest 13F filing from Berkshire Hathaway disclosed a stake of 404,057 shares of Pool Corporation that was worth about $152 million at the end of the third quarter. The price of the stock went from $357.49 at the close up to $378.00 in the after-hours trading session. Unless Berkshire added more shares since the end of the quarter this would not even make Berkshire Hathaway in the Top-10 holders and it would be just over a 1% stake in the entire company. Its $13.6 billion market cap would also imply this was just an opportunistic “buying on the cheap” by a Buffett portfolio manager.

DISCLAIMER

Tactical Bulls does not have any ratings or formal targets on Berkshire Hathaway, Domino’s or Pool stocks. This is not intended to be investment advice nor is it a recommendation to buy or sell any of the stocks mentioned. No investments come with guarantees, not even when they have Warren Buffett and Berkshire Hathaway attributed to them. Any decision to buy or sell a stock is the sole responsibility of each investor and those decisions should be made with a financial advisor.

Categories: Investing