There is nothing better than a stellar growth stock for investors. And in the move from graphics chips to servers to generative-AI, NVIDIA Corp. (NASDAQ: NVDA) has been the stellar growth stock of the NASDAQ-100 and the S&P 500. Analysts have chased the performance of the stock with higher price targets after higher price targets. Then NVIDIA produced yet another great earnings report. And let’s not forget its 10-for-1 stock split. The sky is the limit, right? That was yesterday’s news.

Now that NVIDIA shares have risen 120% so far in 2024 alone, Wall Street analysts may finally be in a situation where the next catalyst to drive shares higher is going to have to be more than just a stellar earnings report with glitzy AI-themed conferences.

Tactical Bulls wanted to see what other stocks in the S&P 500 and the NASDAQ-100 might actually have more upside than NVIDIA over the coming year or so. There were some big surprises from core-economy stocks rather than just the huge technology leaders in this screen of more than 500 stocks. And there are absolutely no assurances or guarantees from the analyst community or anyone else that these stocks will actually outperform NVIDIA’s stock for the next year. That said, this is what the Wall Street analysts’ tea leaves and chicken bones are predicting.

SCREENING RULES

Some stocks were eliminated from the screen if their shares were in a steady decline with no apparent recovery. This may overlook some greatly oversold stocks (a view on that coming soon) to avoid the stocks that only appear to be cheap because their shares have fallen more than the price targets may have anticipated. Quite simply, this screen for uber-NVIDIA performers aimed to avoid junky stocks when screening for more implied investor upside than NVIDIA. That means stocks like Adobe, Autodesk, Gilead, Illumina, Intel, McDonald’s, Lululemon and dozens of others were not candidates for this screen.

Stocks with market capitalization of $10 billion and without multiple analyst calls were also avoided. Calling any of these companies out as “better than NVIDIA” may just be based on the current snapshot in time (end of May, start of June). And none of the screened stocks were included only because they were expecting a big stock split boost!

NVIDIA’s stock peaked at just over $1,150 in recent trading days and closed out May at $1,096.33. The FinViz consensus analyst price target was $1,199.50 on last look, implying upside of just about 10% ahead — and the recent upgrade brigade did have many analysts well above consensus. NVIDIA’s 121% gain year-to-date may have pulled away a lot of the forward growth, even if there is no way to know if that will end up being the case for some time. And NVIDIA’s market cap of $2.7 trillion should speak loud and clear that there remains much excitement from investors. And a Tactical Bull review of what a $2000 NVIDIA stock looks like has already been made.

HERE THEY ARE…

Tactical Bulls always wants readers to keep in mind that stock charts are just one tool of many to consider. And analyst ratings and their price targets are absolutely based on the most current snapshot in time. This screen used many automated tools to filter out the stocks in a state of decline. The rules-based screens will have also missed some other great companies and stocks after the post-automation human touch was applied.

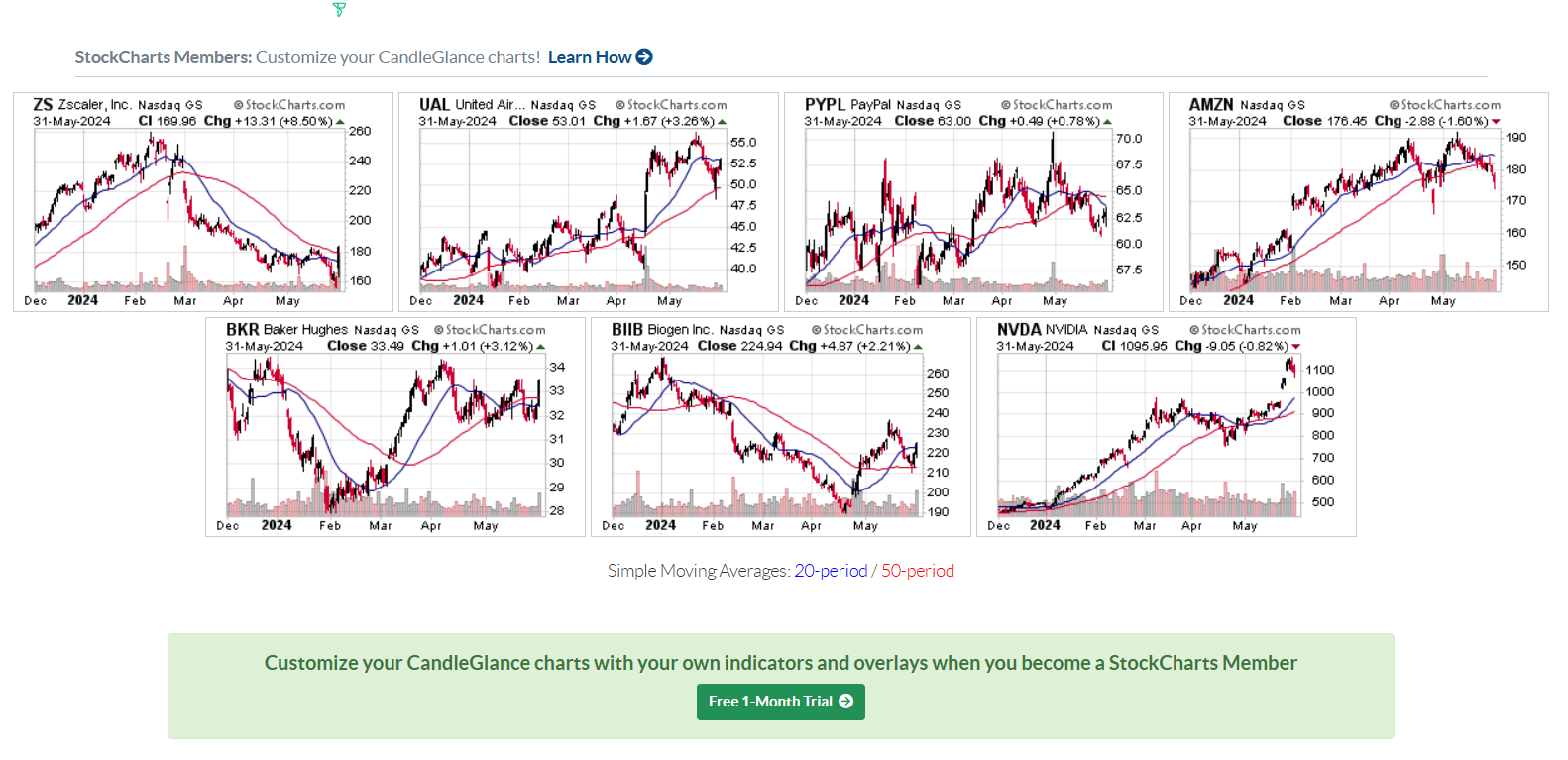

The list of stocks that analysts predict will outperform NVIDIA are shown in alphabetical order to avoid any potential ranking issues. A group of these charts has been provided at the end of this courtesy of StockCharts.com for your review.

Amazon.com

> Implied Upside 25.5%

> Market Cap $1.84 Trillion

Amazon.com Inc. (NASDAQ: AMZN) needs no introduction other than that it is the only of the 30 Dow Jones Industrial Average member stocks to screen with more upside AND a year-to-date chart that may be better than NVIDIA ahead. Analysts jumped all over their prior bullish target prices with even higher targets on May 1 after its earnings report. The shares did briefly rally back up to $190 in the first week of May, but have slid to $176.44 since. The near-term trend has been downward but that has been in a market fighting for new winners and losers with continually mixed data on inflation and the strength of consumer spending and business spending.

UBS, Barclays, Goldman Sachs, Citi, Stifel, Baird, Morgan Stanley, Raymond James, Oppenheimer are just some of the firms which raised their price targets. Even if you used the $185 share price a couple days after earnings rather than the $176.44 close on the last day of May it implies upside of 20% versus 25% at the present time.

Baker Hughes

> Implied Upside 21.8%

> Market Cap $33.4 Billion

Baker Hughes Company (NYSE: BKR) is in the oil and gas services business rather than a key tech stock. Despite what appears to be a strong top around $37 to $38 in the last couple of years, the stock chart for Baker Hughes has been in an uptrend putting in higher lows since 2022. The consensus analyst price target of $40.85 is versus a $33.48 share price as of the last trading day of May.

One issue to consider here is that Baker Hughes has seen its analyst price targets remain high for some time with little change. That could be cause for concern that price targets could compress, but its charts mixed with analyst upside calls look better combined than Exxon, Schlumberger, Chevron and many other leaders in aspects of the oil and gas sector.

Biogen

> Implied Upside 26%

> Market Cap $32.7 Billion

Biogen Inc. (NYSE: BIIB) has multiple potential revenue drivers for big sales ahead, but its sales have been shrinking for about 5 years as MS drug competition heats up. The analyst community sees 2024 to 2025 as the baseline bottoming years before growth ahead. Its Alzheimer’s drug with Eisai is where the big upside potential remains a key driver for the Biogen bulls. The stock chart has bottomed out just under $200 multiple times since 2022, which implies that when (and if) the recovery in sales begins then the shares could see a much stronger recovery.

This is also a case where some analysts are way under the consensus target of about $284. Still, HSBC, H.C. Wainwright and RBC have all listed recent target prices of $300 or higher. There can obviously be no guarantees that turnaround stocks all turn around, but Biogen is one where the stock recovery and the analyst targets keep it a significant potential upside winner. Biogen’s all-time stock high was above $400 back in 2015.

PayPal Holdings

> Implied Upside 20.6%

> Market Cap $66 Billion

PayPal Holdings Inc. (NASDAQ: PYPL) might not have been eligible for the screen a year ago because this stock had been in decline, but since last October the stock is up nearly 25%. And at $63.00 now, analysts are raising their price targets and ratings. A $75.98 consensus price target implies 20.6% upside if the average call is right. That said, multiple firms have upgraded the stock and/or raised their targets in recent weeks.

On May 31, a firm called New Street Research launched new coverage with a Buy rating and assigned a $80 price target. Mizuho raised its rating to Buy from Neutral and raised its target all the way to $90 from $68 on May 30. Keep in mind that PayPal’s post-eBay high was over $300 back in 2021.

United Airlines

> Implied Upside 31%

> Market Cap $17.4 Billion

United Airlines Holdings Inc. (NYSE: UAL) is the legacy air carrier with the best combined chat year-to-date and analyst targets for upside. The consensus analyst target price of $69.52 suggests an implied 31.1% upside from the $52.99 closing price for May-2024. Airlines have been held back by ongoing Boeing woes, and Delta is often considered to have the best reputation while Southwest and American have experienced their own turbulence of late. UAL was nearly a $100 stock back at its peak in 2018.

While a consensus analyst target price of $69.52 sounds strong, Citigroup maintained its Buy rating and raised its target to $96 from $80 on United at the end of May. Jefferies reiterated its Buy rating and raised its target to $65 from $54 at the end of May. HSBC issued a new target of $69.20 in mid-May. Investors have learned over the years that airline stocks have operating risks and event-risk that other stock sectors. So any bad headline or accident can wipe out all that implied upside in the blink of an eye.

Zscaler

> Implied Upside 33.7%

> Market Cap $25.5 Billion

Zscaler Inc. (NASDAQ: ZS) would not have been eligible for this screen even a day earlier, but the large-scale stock price drop in the last 90 days (from $240 to $156 was proven to have been a gross overstep by the bears based on the post-earnings strength. Friday’s gain of 8.5% for the all-encompassing internet security player set the record straight. Tactical Bulls is counting only this same daily reporting of analyst calls as the new consensus and the caveat we make is that there will be more target changes next week. Zscaler’s stock peaked at almost $350 in late 2021 — more than 20-times its $16 IPO price in 2018.

At $169.96 after the 8.5% gain on Friday, the Tactical Bulls tally is an adjusted consensus analyst target price from 14 different same-day analyst calls of $227.35. If these new targets are not dragged down by weaker targets next week then Zscaler’s implied analyst upside would be 33.7%. These are some of the firms in that group of 14 making price target comments: Loop Capital, Scotia, JPMorgan, Oppenheimer, RBC, BTIG, Susquehanna, Barclays, Mizuho and others.

THE CHARTS

This is the snapshot of 6-month candle stick charts from StockCharts.com:

Charts of ZS, UAL, PYPL, AMZN, BKR, BIIB, NVDA courtesy of StockCharts.com

Categories: Investing